What Should My Credit Score Be To Refinance My Car

The higher the number the better the rating. You may want to check.

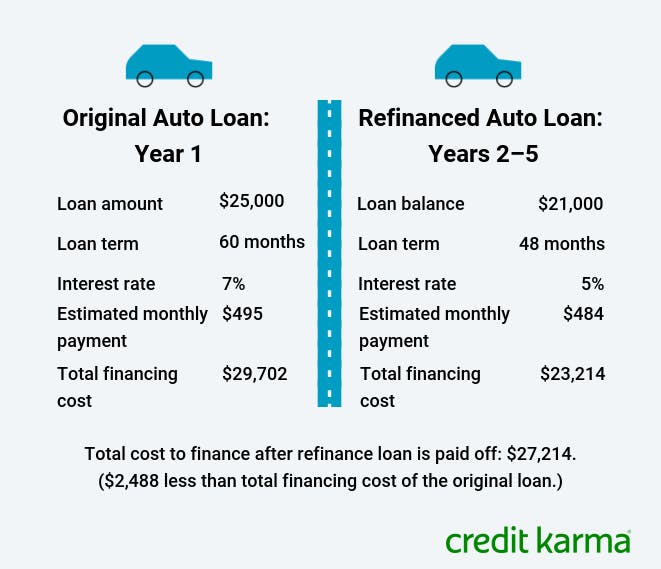

When Should I Refinance My Auto Loan Credit Karma

Each bank or lender has specific refinancing requirements so be sure to ask about the details.

What should my credit score be to refinance my car. If you originally took out a bad credit car loan but your credit score has increased since your loan began you could be eligible for refinancing. Your credit score may have been lower when you took out your original car loan than what it is today. Capital One for example wont refinance a vehicle thats more than seven years old and generally only refinances current loans of 7500 to 50000.

Youll then get a new loan open date which indicates a new credit obligation. The last requirement regarding credit scores is especially important to poor credit borrowers. For example if you have 7500 or more remaining on your car loan 8000 if the loan was made in Minnesota and the car is less than 10 years old with fewer than 125000 miles on it you may be eligible to refinance with Bank of America.

And be sure to check with the lender of your original auto loan to see if a prepayment penalty applies. Youll typically see your score fall by just a handful of points and with continuing positive payment history youll likely see it bounce back relatively quickly. But no matter which they use better credit scores can indicate to lenders that youre more likely to pay off your loan so they may give you a lower rate.

In the second quarter of 2020 people who got a new-car loan had average credit scores of 718 and those who got a used-car loan had average scores of 657 according to the Q2 2020 Experian State of the Automotive Finance. Taking on new debt typically causes your credit score to dip but because refinancing replaces an existing loan with another of roughly the same amount its impact on your credit score is minimal. Your credit score is good or your score has improved since the start of your loan.

Strong credit scores usually help but as mentioned above theyre only one factor in the application process. Or it might send the loan money to you by direct deposit or check which youll then be responsible for using to pay off your original auto loan. The type of refinance you do as well as your debt-to-income DTI ratio can also influence how high of a credit score you need.

Experians credit scores range from 0 to 999. Department of Veterans Affairs VA doesnt impose a minimum credit score for its rate-and-term refinances but its common for VA lenders to require a minimum 620 credit score. The scores calculated by TransUnion and Equifax range from 0-710 and 0-700 respectively.

Much like a credit score there isnt a DTI that automatically disqualifies you from getting an auto refinance loan. When you refinance the old auto loan will be closed. Once approved your new lender may make a payment directly to your current lender.

Your car is old or has a significant amount of miles on it Cars depreciate quickly so youll likely only be able to refinance within the first few years of owning your car. Yes the hard credit pull could decrease your score for a few months but after that most peoples score bounce back. Individuals with a 670 FICO credit score pay a normal 676 interest rate for a 60-month new auto loan beginning in August 2017 while individuals with low FICO scores 620-659 were charged 94 in interest over a similar term.

Now that you know the different factors behind your credit score. If I refinance my car loan how is my original loan paid off. Chances are youll be able to lock down a car loan with a much better interest rate.

If youve earned a substantially higher credit score in the year or so after you took out your car loan you may want refinance. Typically if you have between a 620 and a 639 credit score. If youre timely with your payments then refinancing a car can positively affect your credit.

There also wont yet be a payment history. Some lenders wont refinance cars that are over a certain age or mileage. Ways a new auto loan may affect your credit.

If youve been paying your old auto loan for a while and were timely on payments this change can cause a drop in your credit score. For TransUnion the band for a person they deem to be a good risk spans from 604-627 but for Equifax its 420-465. On Credit Karma you can get your free VantageScore 30 credit scores from TransUnion.

Lenders may use your FICO Auto Scores or base credit scores to help determine your creditworthiness. Youll also pay closing costs and fees. Not sure if your scores have improved.

You Need Extra Cash. This may not be a problem if the. If youre frequently late the opposite is true.

When refinancing is finalized your new loan will appear on your credit report and your payments toward it will be tracked. Your original car loan will remain on your credit report as well. While theres no universal minimum credit score required for a car loan your scores can significantly affect your ability to get approved for a loan and the loan terms.

Some auto refinancing companies have other requirements that must be met no matter your credit scores. The same cant be said for car payments. Though hard credit pulls stay on your report for two years they arent designed to impact your credit that long.

Applying for a refinance car loan can temporarily reduce your credit score because of the hard inquiry the new lender makes on your credit report. Based on RateGeniuss review of auto refinance loan application data from 2015 to 2019 90 of approved applicants had a DTI of less than 48.

How Long Should My Car Loan Be Car Loans Finance Guide Car Loan Calculator

How To Refinance Your Car Loan With Bad Credit Credit Karma

Refinancing An Auto Loan To Save Money Car Loans Loan Saving Money

When Should You Refi Refinance Car Family Budget Budgeting

How To Get Out Of Debt A 10 Step Plan For Becoming Debt Free Credit Score Credit C Consolidate Credit Card Debt Credit Card Consolidation Free Credit Score

When Does Refinancing A Car Loan Make Sense Credit Karma

5 Simple Steps To Refinance Your Car Loan And Pay It Off Faster Car Loans Refinance Car Family Budget

How To Refinance A Car Loan With Bad Credit Read To Get Expert Tips Loans For Bad Credit Car Loans Bad Credit

Refinance My Car Loan With Bad Credit Loans For Bad Credit Car Loans Bad Credit

How Does Refinancing My Car Loan Affect My Credit Rategenius

There Are No Particular Guidelines On When You Can Refinance A Vehicle You Could Theoretically Do So Just A Few Student Debt Payoff Financial Tips Loan Payoff

Why Should I Refinance My Car Loan Valley Auto Loans Car Loans Personal Savings Refinance Car

Should I Refinance My Car Roadloans Refinance Car Car Loans Refinance Loans

Update Auto Refinance Rates Drop After Federal Reserve Reacts To Coronavirus Rategenius

Ask Credit Karma How Does My Auto Loan Refinance Affect My Credit Car Loans Credit Karma Loan

This Website Is Frozen Car Finance Bad Credit Car Loan Car Loans

Review Of Lending Club Refinance New Car Refinancing Loans Personal Finance Blogs Finance Blog Personal Finance Bloggers

Used Car Loan In Hyderabad Car Loans Refinance Loans Refinance Car

Posting Komentar untuk "What Should My Credit Score Be To Refinance My Car"